Why you should really never accept the suggested exchange rate at the atm

October 28, 2021

Why am I drawing attention to the problem?

Why do people try to take additional money from me at the ATM or terminal?

How do they try to take more money from me at the ATM?

How do they try to take more money from me at the terminal through DCC?

What is the difference between an ATM usage fee and a conversion fee?

Is it possible to withdraw money from an ATM without additional fees?

Why am I drawing attention to the problem?

I meet people all the time when travelling who get scammed at ATMs. The problem is that they accept the exchange fee in, for example, Euro € to another currency. First of all:

Never, really NEVER allow the conversion into your home currency! No matter which country you are in! Many banks or ATM operators try to cheat the customer by this conversion.

Why do people try to take additional money from me at the ATM or terminal?

ATMs are mainly provided by financial institutions, the banks (in exceptional cases also by other organisations such as Euronet Worldwide. Be especially careful here because of even higher fees!). The banks act like other companies and want to make as much profit as possible. I myself have worked for more than 5 years for different banks and I can assure you that banks do not exist for the common good! Banks exist to make as much money as possible and maximise profits! And unfortunately they often try to do this by exploiting the ignorance of their customers. Because especially in the time of low interest rates (or zero interest rates), banks hardly earn any money with private customers. Therefore, banks try to get as much money as possible from the customer with every customer contact point! Since fewer and fewer people go to the branches, they try to effectively exploit every contact point with the customer, so that you as a customer/buyer have to pay particular attention to what you accept at the ATM or at the payment terminal. There are mainly two contact points:

ATM

Withdrawing money from the ATM

Payment terminal

Paying for purchases at a terminal with a debit or credit card

How do they try to take more money from me at the ATM?

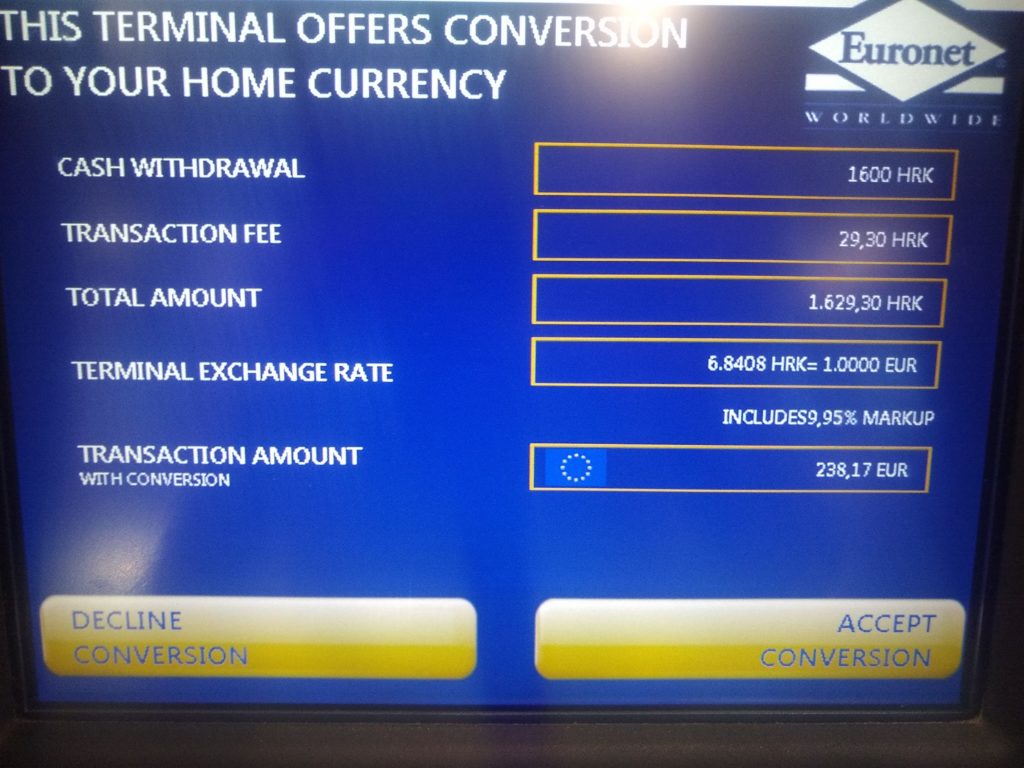

This is where the ATM operator tries to mislead the customer by increasing the exchange rate and charging them more money for the transaction. You should ALWAYS withdraw money in the currency of the country you are in. For example, one should never accept “PAY DIRECTLY in EURO” if the home currency is Euro and one is taking a foreign currency. If you have your bank account (local currency) in the USA, for example, you must never select “PAY DIRECTLY IN USD” while withdrawing money in e.g. Mexico. Otherwise you will always be offered a worse exchange rate, which can vary by up to 20% from the current rate. Let’s go through this current example at an ATM in the Czech Republic:

This example shows the increased fees very well. For a cash withdrawal of 212€, you will be charged 245€ if you accept the exchange rate and “pay directly in euros”. Whereas if you refuse the conversion and pay in HRK, your home bank will only charge you 212€ + a 4€ fee if applicable.

So always be careful that you never allow the conversion! In the end, your bank or credit card provider in your home country will always charge you the amount at the current official exchange rate. And that’s always much better than accepting the exorbitant exchange fees in your holiday country!

Most ATMs will even cheekily ask you twice if you are really sure you don’t want to be charged directly in euros. Don’t let this question mislead you! Never allow automatic conversion! Don’t give the banks your money through such tricks.

How do they try to take more money from me at the terminal through DCC?

DCC stands for Dynamic Currency Conversion and was developed by banks to cheat the unsuspecting buyer out of up to 20% of the money, similar to ATMs. Often without the payer even noticing. Surreally, the banks even try to convince the buyer in PDF documents that DCC is something for the benefit of the buyer and was developed for him. This is of course not the case! Analogous to the automatic conversion at ATMs, the buyer is suggested to pay in the buyer’s home currency at the terminal when paying with the credit card in order to earn more money at the buyer’s expense. Sometimes employees of hotel chains are even trained to set this up at the terminal without the knowledge of the hotel guest, so that the guest can only confirm and usually only realises that he has been cheated by looking at the credit card statement. As I find this very brazen and was myself a victim of such an attempt during a hotel stay in Mexico a month ago, I would like to share this example:

Normally, all payments abroad are displayed in the local currency on the credit card terminal. If this is not the case and the buyer only has to enter his PIN in the terminal and does not see the amount entered and confirmed, be careful! In this case, it is possible that DCC is being used and it is important to check the payment receipt and, if necessary, also the credit card invoice.

In the example I chose, I had booked two nights in a 4-star hotel in the Mexican border town of Ciudad Juarez and only had to confirm the terminal with my password without seeing the amount entered to it. When I checked my credit card bill two days later, I found that I had been charged in euros instead of Mexican pesos and that the amount charged was 8% higher than agreed. I then sought to speak to the receptionist and informed them that they had probably used DCC without informing me. After the receptionist spoke to their terminal provider (BANORTE Mexico) on the phone, she informed me that they had done everything right and that my bank was responsible for the overpriced charges. Fortunately, I persisted and asked to speak to the manager of the reception and operate the terminal together with him.

As it turned out, during the payment process, the terminal asked if DCC should be applied to the amount entered in Mexican pesos and if you accept to be charged in Euro then. You were then asked to confirm by pressing the green button on the terminal which the receptionist always did before passing it over to the customer. The receptionist insisted that she had been trained that way. Of course, in this case the customer has to be asked first and you have to reject the automatic currency conversion (DCC) with the red button in order not to pay more money. I was then refunded the incorrectly corrected amount.

So please remember, never agree to the automatic conversion in your home currency.

What is the difference between an ATM usage fee and a conversion fee?

I would like to briefly explain the difference between the conversion fee and the ATM usage fee and which one we have to avoid.

ATM usage fee

The fee differs from ATM operator to ATM operator. Some banks offer low user fees, some more expensive ones. You usually have to pay this fee if you do not use the ATM operator’s credit card. There are credit card providers who will reimburse you for this fee. In Germany, however, I don’t know of any bank that currently guarantees this (until 2017, DKB did this, for example). It’s best to find out where the fees are lowest before you go abroad and mainly withdraw money from these machines. In Mexico, for example, this ATM fee varies between 12 MXP (0.6 USD) and 80 MXP (4 USD). BanCoppel is the cheapest provider for cash withdrawals.

Conversion fee

The conversion fee, as described in several questions above, is the fee you are asked not to confirm and never to accept. This fee only serves the ATM operator or terminal operator to mislead the customer and to take more of your money away into their own pockets. So be careful when paying or taking money in a foreign country.

Is it possible to withdraw money from an ATM without additional fees?

Yes, you can at many ATMs! Meanwhile, many banks with a free credit card also offer the possibility to withdraw money from an ATM without additional fees and at current interbanking fees. But beware, it is extremely important to pay attention to what you confirm with the ATM during the transaction! Otherwise the ATM where you take the money from may charge you the described conversion fee. And you may want to use that money for something else.

ATM scams are also becoming more popular. In this article ATM Scams: What Everyone Should Know and how to dodge them – I dive into the most popular scams and give 9 tips how to protect yourself from them.

Philipines:

HSBC seems to be the only bank which does not charge you a fee.

[…] Why you should really never accept the suggested exchange rate at the atm […]

Colombia:

Seems only one bank without credit card withdraw fees:

Davivienda (you can also withdraw up to 2 Mio. COP)

Thailand:

AEON Bank has the lowest fee for a withdrawal in Thailand with 150 Baht. Most other banks charge 300 Baht

Canada:

In Canada you pay a fee at all atms. Sadly there are no atms without a fee.

Guatemala:

There are high fees in Guatemala when trying to get money from the atm.

The lowest fee in 2023 seem to be at the BI, where they charge you 4 USD for 2000q. There are some atms from BI where you can also get 3000q for 4 USD.

Turkey:

A few banks are free of credit card charge in Turkey – but take care with DCC!

Halkbank

Ziraat

HSBC

Uganda:

In Uganda you have the DEFCU Bank atm’s which are free of charges for a credit card

Malawi

2 banks without fees:

Centenary Bank and DFCU Bank

Rwuanda:

In Rwuanda you have the atm’s of KCB which are free of charge for credit card withdrawals

Tanzania:

KCB is free of charge.

Take care with these banks, they charge a very high fee:

NBC

ABSA

Mexico:

The bank with the lowest fee for credit card withdrawal in Mexico is Bancoppel. They offer normally atm’s close to there Coppel stores.

Caja Popular does also have lower fees. Now they are on 17mxn

Mozambique:

At the following banks you don’t pay atm withdrawal fees in Mozambique:

FNB

Moza

BCI

Eswatini/Swaziland:

At the FNB Bank you don’t pay an atm fee for withdrawals in Eswatini

South Africa:

I only found “Standard Bank” without atm withdrawal fee for credit cards in South Africa. They provide atms at many petrol stations

Lesotho:

At the FNB Bank you can get money without an atm withdrawal fee in Lesotho

Sehr guter Artikel!

Übrigens ist paypal auch nicht viel besser: Bei Zahlung in Fremdwährung genehmigen die sich auch eine Marge, gegen die die üblichen Fremdwährungsentgelte der Kreditkartenanbieter (i.d.R. 0-2,5%, dafür aber auf einen “echten” Interbankenkurs- hier lohnt auch ein Vergleichen der Kreditkartenanbieter) eher noch günstig sind.

Hi Uli,

absolut und sehr guter Punkt! Mit Paypal habe ich damit leider auch schon Erfahrungen gemacht. Häufig bei der Nutzung von Uber und der Zahlung in der Fremdwährung (dann mit Aufschlag). Ich werde mal schauen, dass ich ein paar Kreditkartenanbieter mit aufnehme die hier positiv hervorzuheben sind :).

New Update with Informations about the ATMs and DCC 2021-10-28

✌🏻Hiermit verspreche ich – hoch und heilig – niemals jemals nirgendwo die Umwandlung des abzuhebenden Betrags in Euro durch die Bank zu akzeptieren!✌🏻